Embedded Finance

We enable you to provide payments and financing experiences that will delight your customers

Enrich your customer experiences using our modular and configurable platform

Key features

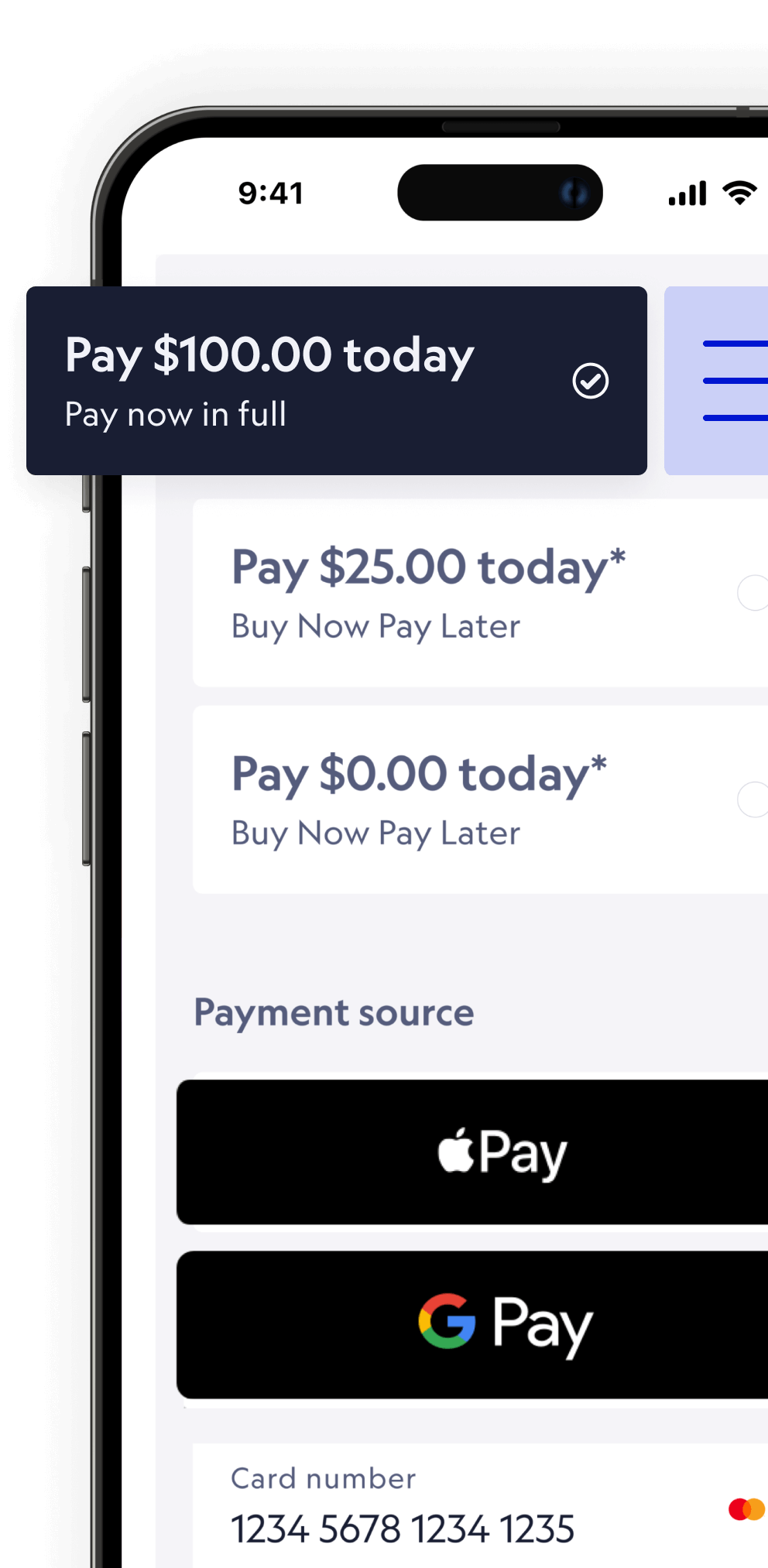

Integrate our modular embedded finance solution into your purchasing experience and configure to your business needs.

- Payment processing

- Instalment options

- Lending solutions

- Fraud protection

- Working capital

- Sub-merchant management for marketplaces

- Subscriptions

- Tokenisation

- Fast payout option

- Eligibility engine

- Dashboards for both businesses & customers

Why April?

Leverage our integrated experiences to:

- Increase basket size

- Reduce friction

- Increase conversion

- Improve cash flow

Modern financing solutions

Easily configurable to suit your business needs

Dedicated support

Latest technology

Safe and secure platform

Strengthen the relationship with your customers by keeping your brand throughout. No third party redirects

Simple integration and developer experience

Fast and agile team to accelerate your time to market